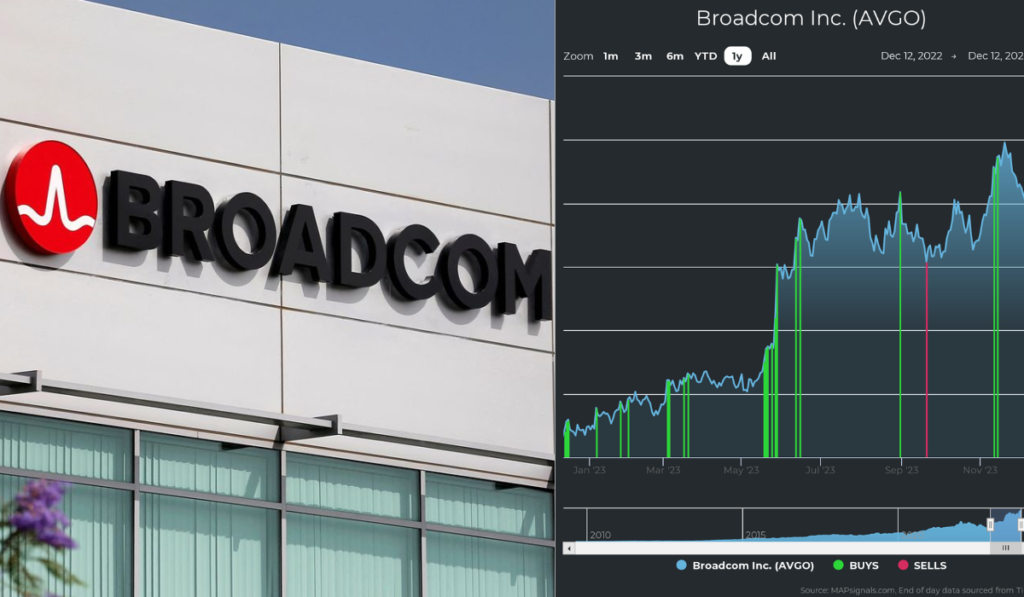

Broadcom Inc. (AVGO) Sees Third Consecutive Record High in Stock Price Due to Analysts’ Revised Projections, On Wednesday, Broadcom Inc.’s shares soared to a historic high for the third consecutive day, fueled by analysts’ increased price target for the stock.

Bank of America securities analysts, following a virtual meeting with key company executives including CEO Hock Tan, CFO Kirsten Spears, and Head of Investor Relations Ji Yoo, heightened their price target from $1,200 to $1,250.

Their discussion highlighted Broadcom’s strategic emphasis on optimizing cost synergies from its $61 billion acquisition of cloud computing firm VMWare, its expansion into generative artificial intelligence (AI), stable non-AI legacy business, and robust profit margins.

The analysts emphasized Broadcom’s unique position in offering an attractive valuation along with substantial free cash flow generation and returns. They affirmed that the elevated price target mirrors the company’s sustained growth trajectory.

Moreover, Citi reinstated coverage of Broadcom on Monday with a “buy” rating, acknowledging the company’s core business strengths and the advantages gained through the acquisition of VMWare.

As of 2:45 p.m. ET Wednesday, Broadcom’s shares surged by 2.2% to $1,095.84 each, marking an impressive near-doubling in value for the year.