Indian stock markets ended the last week of 2023 with gains of about one and a half percentage points. This week, investors are paying attention to several important events that might influence the markets globally.

They are looking at things like how well companies are doing, how much they are selling, and how much money India has saved. Also, they are interested in how much oil the US has, the plans of the US government about money, and how many people are getting jobs in the US. These things will keep the markets active and interesting.

US Market Data : From the United States, even though it’s a holiday week, traders are interested in finding out a lot of important things. They want to know how companies in the US are doing that make things, then how much oil the US has, and how many people are getting jobs. All this information will be released from January 2 to January 5.

According to experts, Asian and European stocks were doing well towards the end of 2023. They think that investors felt good because they believe that the US government will start reducing how much money it takes from people next year. Also, they say that the Nifty, an important stock market indicator, went up a bit after falling a few times in the week. They predict that it might continue to rise more but might also fall a bit sometimes.

Economic Data : Coming to the start of the New Year, it looks like the first week of 2024 will have a lot of important information about how businesses are doing. Investors are eagerly waiting for reports on how many cars and other vehicles companies sold last month. Then, on January 3, there will be a report about how well companies that make things are doing. Last November, these companies did slightly better compared to October month.

Similarly, on January 5, there will be a report on how companies that provide services, like banking or restaurants, did in December. In November, they did a bit less well than the month before. On the same day, we’ll also get to know how much money India has in savings that it can use when needed.

Related video: Survey: U.S. sentiment around the economy improves (MSNBC)

Regarding the Bank Nifty, another important indicator, it seems to have gone down a bit recently. Experts suggest that unless it goes above a certain number, it might keep going down. But if it goes above that number, it might go up again.

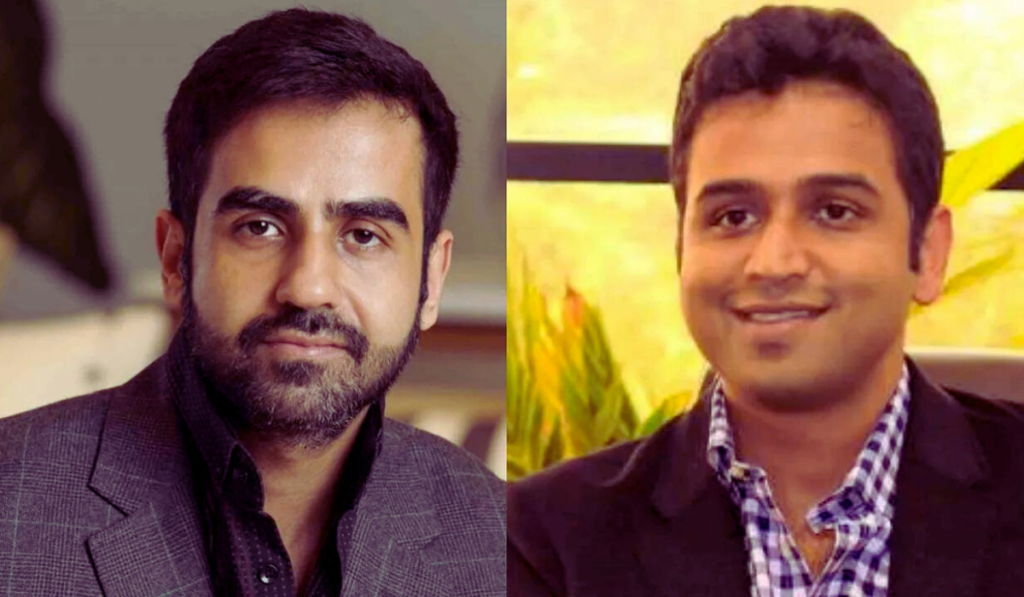

Market Outlook Analysis : The Deepak Jasani, Head of Retail Research at HDFC Bank Securities, said the Asian stocks took a breather on the last trading day of the year of period and the snapped their two-year losing streak with investors buoyed by the expectations that the Federal Reserve will start cutting interest rates next year. European stocks started the final session of 2023 year higher, marking a positive end to a solid year, that he said.

Jasani said the Nifty corrected after rising for 5 sessions but closed the week higher by 1.79 per cent. “It closed the month higher by 7.9 per cent and higher by 20 per cent in the year. Nifty formed a sideways doji having little predictive value. The upward momentum is still strong negative and the Nifty could rise towards 21,801 and the later 21,920. On the downside, 21,675 and 21,505 could offer support, that he said.

Nifty Bank: Rupak De, Senior Technical Analyst at LKP Securities, said that the Bank Nifty slipped lower, forming a small red-bodied candle on the daily chart. “Resistance is situated at 48300 on the higher end. As long as the index stays below 48300, and the trend could lean towards favoring bears. Moreover, a decisive drop below 48000 might drive the index below 47500. Conversely, a decisive move above 48300 this could propel the index towards 48800-49000 on the higher end of period.